Most retail investors in Europe face a dilemma: should they chase fast-growing companies with sky-high valuations, or stick to safe, slow-moving value stocks? The truth is, neither extreme feels right for someone who wants to build wealth steadily, without gambling or falling into hype.

This is where Growth at a Reasonable Price (GARP) comes in. Popularized by the legendary investor Peter Lynch, GARP is a hybrid strategy that blends the discipline of value investing with the excitement of growth investing. It’s about finding companies that are growing—but not at prices that make you lose your mind.

Think of GARP as the investor’s middle path: avoiding the frenzy of speculation, while still embracing opportunities for compounding wealth. In this guide, we’ll break down what GARP is, how Peter Lynch applied it, and how you can use it in your own long-term investing journey.

⚡Key Takeaways

- GARP = Growth + Value: It’s about finding companies with strong growth prospects, but at reasonable valuations.

- Peter Lynch’s PEG ratio: A simple tool to measure whether growth is worth the price.

- Investor mindset: GARP requires patience, discipline, and resisting hype.

- Pros and cons: GARP balances risk and reward, but it’s not foolproof.

What Is Growth at a Reasonable Price (GARP)?

At its core, GARP is about balance. Traditional value investors look for cheap stocks, often in mature industries. Growth investors chase companies with explosive earnings potential, often paying high multiples. GARP sits in between.

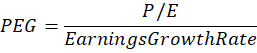

Peter Lynch, who managed Fidelity’s Magellan Fund from 1977 to 1990, believed that investors should focus on companies growing faster than the market average—but only if their valuations weren’t excessive. His favorite tool was the PEG ratio:

- A PEG ratio around 1.0 means the price you’re paying is roughly in line with the company’s growth.

- Below 1.0 suggests undervaluation relative to growth.

- Above 1.0 suggests you may be overpaying.

For Lynch, GARP wasn’t about chasing the hottest tech stock. It was about finding companies with sustainable growth, reasonable valuations, and understandable business models.

How to Invest Like Peter Lynch Using GARP

Peter Lynch’s approach was famously simple, yet effective. Here’s how you can apply his GARP principles today:

1. Look for understandable businesses

Lynch often said, “Invest in what you know.” For most investors, this could mean companies you interact with daily—whether it’s a retailer like Amazon, a food giant like Nestlé, or a fintech innovator like Wise.

2. Use the PEG ratio as a filter

Don’t just look at the P/E ratio. Compare it to the company’s growth rate. A company with a P/E of 20 and growth of 20% has a PEG of 1.0—reasonable. A company with a P/E of 50 and growth of 10% has a PEG of 5.0—likely overpriced.

3. Think long-term

Lynch held stocks for years, letting compounding do the heavy lifting. GARP isn’t about quick wins—it’s about steady wealth-building. The majority of his big winners only reveal themselves after 3 to 5 years of owning a stock.

4. Avoid hype-driven sectors

Just because everyone is talking about AI or crypto doesn’t mean valuations are reasonable. Most often, opportunities are hidden in companies growing in boring and stale sectors. GARP forces you to ask: Is the growth real, and is the price fair?

Pros and Cons of GARP Investing

Like any strategy, GARP has strengths and weaknesses.

✅ Pros

- Balanced risk: Avoids overpaying for growth, while still capturing upside.

- Accessible: PEG ratio is simple to calculate and apply.

- Long-term focus: Encourages patience and compounding.

- Flexibility: Works across sectors and geographies.

❌ Cons

- Data sensitivity: PEG relies on accurate growth estimates, which can be wrong.

- Market cycles: In bubbles, even GARP stocks can look expensive.

- Not pure value: Hardcore value investors may see GARP as too optimistic.

- Requires discipline: Easy to slip into chasing growth without checking valuation.

GARP investors must accept that markets will swing, forecasts will miss, and hype will rise. The discipline lies in sticking to reasonable valuations and resisting emotional decisions.

Applying GARP Today

Markets offer fertile ground for GARP investors if you only know what to look for. Here are some practical steps to help you follow this investment strategy:

- Screen for companies with PEG ratios near or below 1.0.

- Read annual reports to understand business models.

- Compare growth rates with competitors and sector averages.

- Diversify across industries and countries.

- Keep a journal of your investment decisions—note why you bought, and revisit later to check your reasoning.

Conclusion

Growth at a Reasonable Price (GARP) is more than a formula—it’s a mindset. It teaches us to embrace growth without losing discipline, to seek opportunity without succumbing to hype. For retail investors, GARP offers a practical, balanced way to build wealth over decades.

👉 Action step: Start by screening companies using the PEG ratio. Focus on businesses you understand, with sustainable growth and fair valuations. Keep your emotions in check, and let compounding work quietly in your favor.