Investing isn’t about chasing the hottest stock or timing the market perfectly. Wise investing is about protecting yourself first, and growing wealth second. That’s where the Margin of Safety comes in. Warren Buffett said it best on investing: “Rule 1: never lose money. Rule 2: never forget Rule 1”.

The concept of Margin of Safety was popularized by Benjamin Graham, the father of value investing and great mentor to Buffett. Simply put, it’s the buffer between what you pay for a stock and what it’s truly worth. Think of it as your insurance policy against uncertainty.

By insisting on this cushion, you reduce the risk of costly mistakes and give yourself room to breathe when markets turn volatile. You can’t control markets, but you can control the price you pay and the risks you accept.

This post will break down the margin of safety in plain language, show you how to calculate it, and explain why it’s the cornerstone of safe investing principles for European investors.

⚡Key Takeaways

- Margin of Safety = Buffer Against Risk: It’s the gap between intrinsic value and market price.

- Protects Against Uncertainty: Markets are unpredictable; margin of safety gives you breathing room.

- Calculation Matters: Learn how to calculate margin of safety using intrinsic value estimates.

- Safe Investing Principles: A disciplined mindset is as important as the math.

What Is Margin of Safety?

At its core, the Margin of Safety is about buying stocks at a discount to their intrinsic value. Having a buffer between what you believe is the company’s true worth and the price you pay for it can make all the difference in the end.

Why does this matter? Because valuations are never perfect. Investors make assumptions, markets shift, and unexpected events happen. By insisting on a margin of safety, you protect yourself against errors in judgment and unforeseen risks.

Think of it as risk management in its purest form. You can’t control the economy, interest rates, or sudden market shocks. But you can control the price you pay and the standards you set.

How to Calculate Margin of Safety

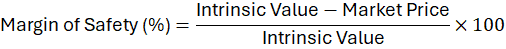

Formula:

Example:

Let’s illustrate this with an example. Say you value a company at €100 per share based on fundamentals (intrinsic value) and you buy it for €70 – in this case, your margin of safety is 30%.

- Intrinsic Value: €100

- Market Price: €70

- Margin of Safety = (100 – 70) ÷ 100 = 30%

This calculation requires estimating intrinsic value, which alone is a topic that deserves a dedicated post (or several). But intrinsic value is in its essence the true value of a business based on fundamentals. This can be estimated using different approaches:

- Discounted Cash Flow (DCF): Projecting future cash flows and discounting them back.

- Price-to-Earnings Ratios(P/E): Comparing valuation multiples to industry averages.

- Price/Earnings-to-Growth (PEG) Ratio: Using a company’s earnings and expected growth rate.

- Asset-Based Valuation: Looking at tangible book value.

The key is not precision but prudence. As Graham himself said, valuation is an art, not a science. The margin of safety is your cushion against inevitable miscalculations.

Investment Psychology and Margin of Safety

Numbers alone don’t make you a wise investor. The Margin of Safety is as much about psychology as it is about valuation. Successful investors don’t just calculate—they cultivate a mindset that allows them to act rationally:

- Patience: Waiting for the right price requires discipline.

- Resilience: Markets will test your resolve; margin of safety helps you stay calm.

- Humility: Acknowledging that we might be wrong, that markets might surprise us, and that risk is ever-present.

The psychology behind applying a Margin of Safety will help you invest with more clarity and confidence.

When Investors Ignore Margin of Safety

The Margin of Safety is simple in theory but often ignored in practice. Many investors—especially retail investors—fall into traps that erode their discipline and expose them to unnecessary risk. Understanding these pitfalls is crucial if you want to build wealth steadily and avoid painful mistakes.

Common Pitfalls

1. Chasing Hype and Hot Tips

Markets are full of noise: social media buzz, financial influencers, and “can’t-miss” stock tips. When investors buy into hype without demanding a margin of safety, they often pay inflated prices.

2. Overconfidence in Valuation Models

Valuation is an art, not a science. Yet many investors treat their models as gospel. But even the best models rely on assumptions—future growth rates, interest rates, market conditions—that can change overnight.

3. Ignoring Risk Management in Volatile Sectors

Sectors like biotech, fintech, or renewable energy are exciting but volatile. Investors often buy into these industries at high valuations, convinced growth will justify the price. Without a margin of safety, they’re exposed to sharp downturns.

4. Short-Term Thinking and Impatience

Many investors abandon margin of safety because they want quick gains. They buy at fair value or even above it, hoping momentum will carry them.

Conclusion

The Margin of Safety is not just a formula—it’s a philosophy. It’s about protecting yourself from uncertainty, building wealth steadily, and investing with clarity.

👉 Actionable Step: Before buying any stock, calculate its intrinsic value and demand a margin of safety of at least 20–30%. This simple discipline can transform your investing journey.