Most investors hear about Compound Interest early on, but few truly grasp its power. It’s not just a mathematical curiosity — it’s the quiet engine behind long-term investing, investment growth, and wealth accumulation.

In a world obsessed with quick wins and flashy trades, Compound Interest reminds us of a Stoic truth: time and discipline matter more than excitement. The investor who embraces patience and ownership builds wealth steadily, without chasing hype.

This post will explain how Compound Interest really works, why it’s essential for retail investors, and how you can harness it for your own wealth-building strategies.

⚡Key Takeaways

- Compound Interest is exponential growth in disguise. Small gains reinvested consistently become powerful over decades.

- Time is your greatest ally. The earlier you start, the less effort you need later.

- Consistency beats intensity. Regular contributions matter more than occasional big bets.

- Practical application is simple. Automate savings, reinvest dividends, and stay invested through market cycles.

What Is Compound Interest?

The concept often feels somewhat abstract. Let’s break it down in plain language.

At its core, Compound Interest means earning interest not only on your initial investment but also on the interest that investment has already generated.

Simple vs. Compound Interest

- Simple Interest: You earn interest only on your original investment (the principal).

- Example: 1.000€ at 5% simple interest = 50€ per year, every year. After 10 years, you have 1.500€.

- Compound Interest: You earn interest on your principal and on the interest that has already been added.

- Example: 1.000€ at 5% Compound Interest = 50€ in year one, but in year two you earn interest on 1.050€, not just 1.000€. After 10 years, you have ~1.629€.

That extra 129€ is the quiet magic of compounding. It’s not dramatic in the short term, but over decades it becomes transformative.

The Formula

Mathematically, it’s expressed as:

Where:

- = final amount

- = principal (your starting money)

- = annual interest rate

- = number of compounding periods per year

- = time in years

But don’t get lost in the math. The essence is this: the more often your returns are reinvested, and the longer they stay invested, the faster your money grows.

Everyday Analogy

Think of Compound Interest like planting a tree:

- In the first year, it’s just a sapling.

- By year five, it’s taller and stronger.

- By year twenty, it’s producing shade, fruit, and seeds that grow into new trees.

Your money behaves the same way. Interest produces more interest, which produces more growth.

How Compound Interest Really Works

Compound Interest is often described as “interest on interest,” but that phrase doesn’t capture the full force of what’s happening. To truly understand how it works, you need to see how small, consistent gains snowball into something far larger than most people expect.

The Mechanics of Compounding

When you invest, your money earns a return. If you reinvest that return, your next round of earnings is calculated on a bigger base. Over time, this creates an exponential curve rather than a straight line.

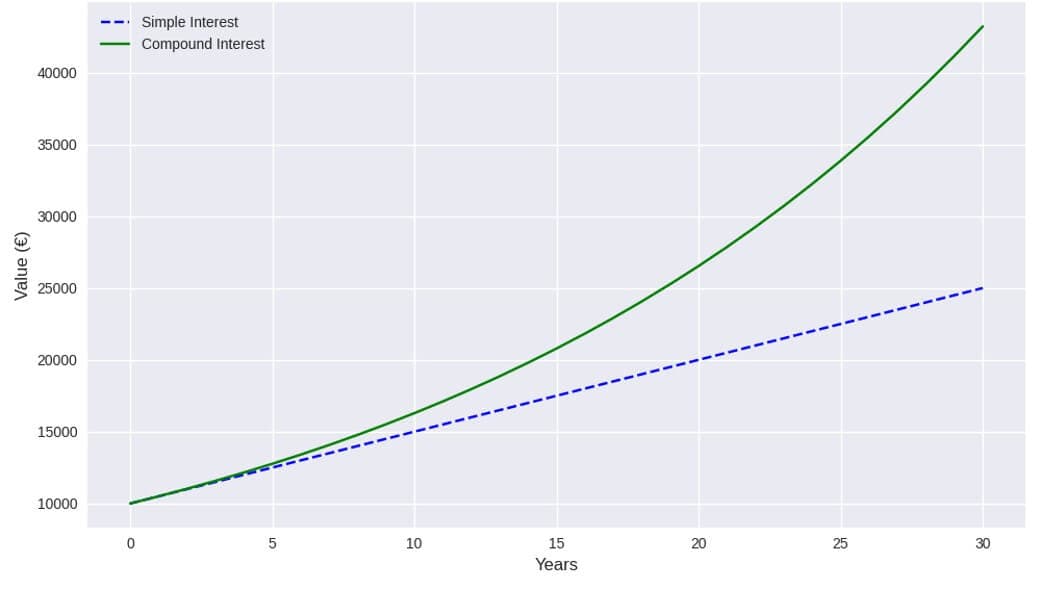

Imagine you invest 10.000€ at 5% annual return, compounded yearly:

- Year 1: 10.000€ × 1,05 = 10.500€ → 500€ growth

- Year 2: 10.500€ × 1,05 = 11.025€ → 525€ growth

- Year 3: 11.025€ × 1,05 = 11.576€ → 551€ growth

Notice how each year’s growth builds on the previous year’s total, not just the original 10.000€. That’s the compounding effect in action.

Time as the Multiplier

The secret ingredient is time. The longer you stay invested, the more dramatic the curve becomes:

- 10 years: 10.000€ grows to 16.289€

- 20 years: 10.000€ grows to 26.533€

- 30 years: 10.000€ grows to 43.219€

The first decade feels modest. The second decade doubles your wealth. The third decade explodes into something transformative.

This is why Compound Interest is often called the “eighth wonder of the world.” It rewards patience more than brilliance.

The Long-Term Effect of Compound Interest

Compound Interest is often underestimated because its early impact feels modest. But the true power reveals itself over decades. The longer you stay invested, the more dramatic the curve becomes — and this is where wealth accumulation shifts from incremental to transformational.

Numbers That Tell the Story

Let’s revisit our example above: 10.000€ invested at 5% annual return. Notice the acceleration:

- The first 10 years add 6.289€.

- The second 10 years add 10.244€.

- The third 10 years add 16.686€.

The longer you stay invested, the faster the growth. This is the exponential nature of compounding — it rewards patience disproportionately.

Monthly Contribution Example

Now let’s try something different: start with zero capital and add regular contributions to see the long-term effect more clearly. Suppose you invest 250€ per month at 5% annual return:

- 10 years: ~38.000€

- 20 years: ~99.000€

- 30 years: ~199.000€

As you can see here, discipline matters more than starting capital. Even modest monthly contributions snowball into significant wealth when left to compound.

Practical Examples

Compound Interest is not just a theory — it plays out in everyday investment vehicles. Let’s look at practical examples where compounding works quietly in your favor, provided you stay disciplined and patient.

1. Index Funds & ETFs

Low-cost index funds and ETFs are the backbone of many long-term investors. When dividends are automatically reinvested the fund’s growth compounds year after year. And with fees as low as 0.1–0.2%, more of your returns stay invested, accelerating compounding.

2. Dividend Stocks

European blue-chip companies often pay steady dividends. Take advantage of compounding by reinvesting dividends into buying more shares, which then generate more dividends. Over decades, dividend reinvestment can double or triple your total returns compared to taking cash payouts.

3. Retirement Accounts

Many European countries offer tax-advantaged retirement accounts that supercharge compounding. The same is true for USA and other regions of the world. Remember to check what is applicable to your specific case.

4. Regular Savings Plans

Banks and brokers across Europe offer automated monthly investment plans. Automation removes emotion and ensures consistency, the key ingredients for compounding.

5. Slow Investing Philosophy

Instead of chasing trends, European investors can embrace a “slow investing” mindset. Focus on consistent contributions, reinvestment, and long-term holding periods. Compounding rewards calmness during volatility. The investor who resists panic selling benefits most.

Conclusion

Compound Interest is not a trick or a shortcut — it’s a philosophy of wealth building. It teaches us that time and discipline are the most powerful forces in investing. Start early. Stay consistent. Reinvest earnings. It’s that simple.

👉 Actionable Step: Focus on what you control, ignore what you don’t, and let time do the heavy lifting.